If you need networked access and/or multi user privilege control then you need MoneyWorks Gold or MoneyWorks Datacentre Server.ĭatacentre has all the same functionality as MoneyWorks Gold (MoneyWorks Gold is the network client), but with the convenience, scalability, and interoperability opportunities of server-based systems, including access from mobile devices. Report Signing to secure access to sensitive data-only authorised users will be allowed to use the report. Sort and consolidate accounts by Accountant’s code.įull expression evaluation including access to internal variables, database lookups and built-in functions.įor advanced reporting, you can use programming language-like control constructs (For loops, If/Else) Preview on screen, or output to PDF, Email, Excel, Word, Numbers, Clipboard, text or HTML file

Moneyworks express. trial#

Simple to create GL reports, but with the power to use any data in your database.Ĭomes with Trial Balance, Income, Cashflow, GST, Cash Projection, Ledger and Balance Sheet, plus profit, trading, inventory, sales, job and budget reports. There is no limit to the reporting power of MoneyWorks. In addition to a wealth of standard reports, MoneyWorks Gold includes a powerful report writer that allows you to create your own reports.Ĭreate detailed reports to give exactly the information you need in the format you choose. In other countries simply use the figures provided on the general GST/VAT and/or sales tax reportsĪll MoneyWorks products come with a large selection of standard reports appropriate to the functionality of the product.

Moneyworks express. code#

Tax code override for individual customers or suppliers (useful for offshore transactions).Ĭountry-specific guides for form filling supplied for New Zealand (GST Return guide), Australia (BAS Guide), Singapore (IRAS), Nepal (VAT Guide), UK (VAT Guide). GST/VAT handling is based on ‘transaction tagging’, so you never need worry that a transaction has been omitted or double-counted.ĭetailed reporting provides complete audit trail. MoneyWorks was designed from the ground up to provide the best possible support for GST/VAT-type taxes, plus it also supports North-American-style sales taxes.Įnter amounts as GST inclusive or exclusive-MoneyWorks does the rest.ĭefault GST is based on general ledger code used, so you never need to worry about charging GST on wages or other exempt/free items.Ĭomplete handling of GST on both invoice/accrual and payments/cash basis.

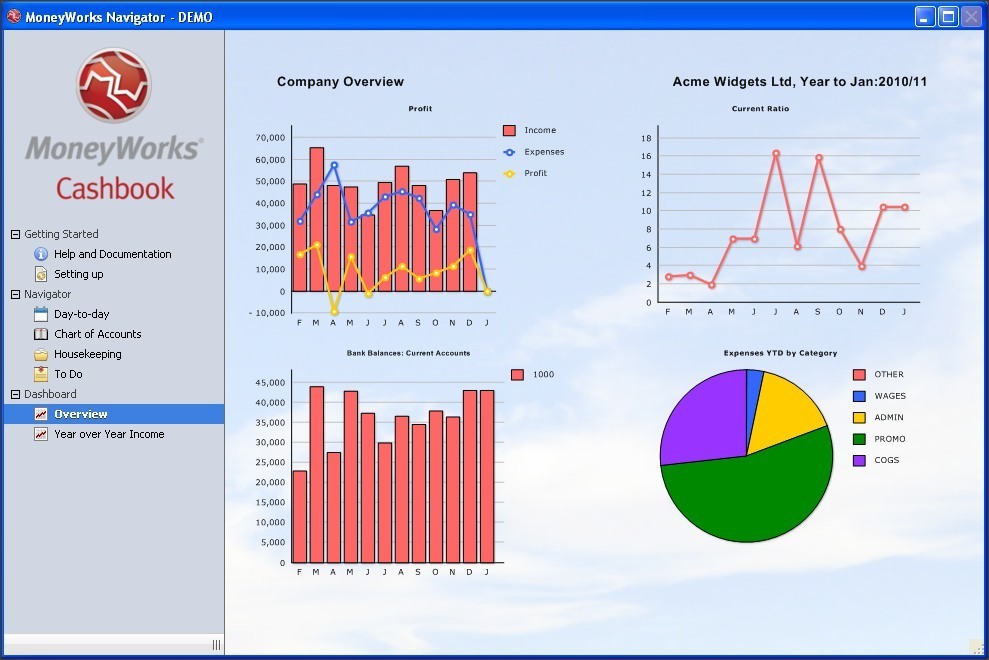

Use your own codes in-house to provide the degree of breakdown that you need, but give your accountant reports based on their preferred coding structure. Reports and graphical analysis going back up to 7 years. No end-of-month or end-of-year rollover-have up to 90 periods open simultaneously.Īccount movement graphs with drill-down to actual transactions.ħ character free-form account codes for reporting flexibility Use the built-in budget editor or copy and paste from an external spreadsheet, or Import/Export budgets

Moneyworks express. full#

Advanced department capability in MoneyWorks provides independent cost centres and dual budgets provide full budgeting support right down to department level.Ĭompletely flexible chart of accounts allows MoneyWorks to operate the way your business does.įull budgeting-with two separate budgets.

Maintains details of your accounts for over 7 years. Quick allocation of income and expenses by predefined rules Import downloaded bank statements in QIF, OFX, QBO formats Point and click bank reconciliation-no need to re-enter your bank statement. Print cheques or create electronic direct payment files for supported banks. Recurring transactions save re-entering repetitive items such as wages. Record payments and receipts and automatically track the GST.

0 kommentar(er)

0 kommentar(er)